Ethics and Compliance

We are proud of our culture and the values upon which it is centered — they form the foundation of our ongoing success. One of our foremost core values, “Integrity is Everything,” guides the actions of our leaders and associates for our Company and is one of our competitive differentiators. Essential policies that guide ADP include:

- Code of Business Conduct & Ethics

- Code of Ethics for Principal Executive Officer and Senior Financial Officers

- Anti-Bribery Policy

- Insider Trading Policy

- Modern Slavery Statement

- Vendor Code of Conduct

Global Ethics

ADP’s Global Ethics team offers our associates advice, training, counsel and support on all aspects of the Code of Business Conduct & Ethics and the Anti-Bribery Policy. In addition, Global Ethics conducts investigations into ethical matters and issues reported through a variety of ways, including ADP’s Ethics Helpline, and supports the Chief Administrative Officer (CAO) in reporting to the Board of Directors and Audit Committee.

- Investigations: Global Ethics has a formal process where every report received, including those from whistleblowers, regardless of where it comes from (e.g., the ADP Ethics Helpline, email, phone, in person) or who it comes from (e.g., associate, contractor, vendor, client, unrelated 3rd party), is acknowledged, investigated and addressed as appropriate, and recorded in our case management system. Depending on the nature of the risks and trends observed, Global Ethics may recommend certain remedial or proactive actions, including training, communications and audits.

- Reporting: Global Ethics provides regular reporting to the Audit Committee on the number and types of ethics investigations with information on trends tied to specified ethics-related categories of risks identified under ADP’s Enterprise Risk Management program.

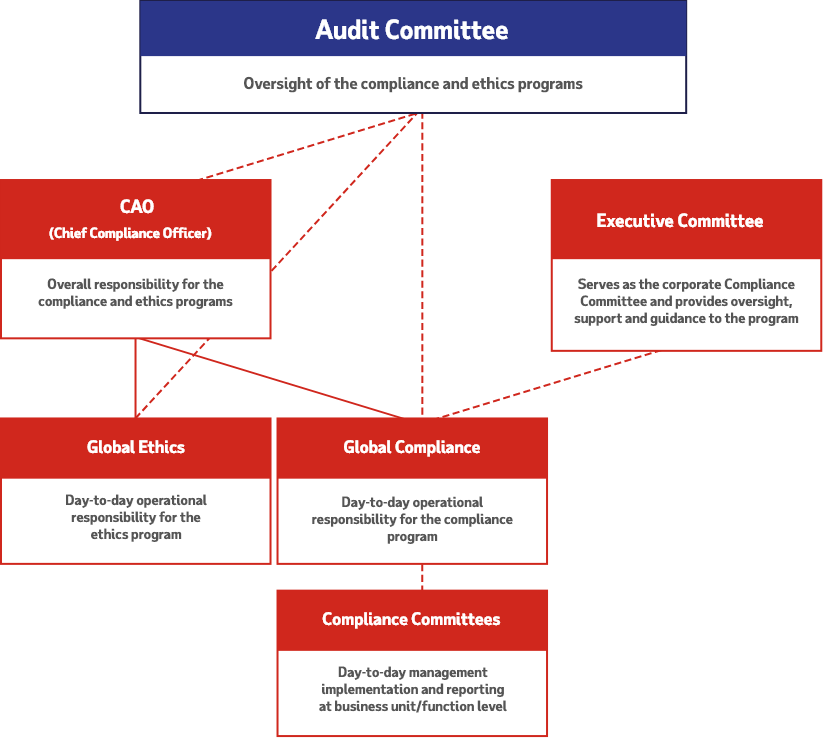

Oversight and Structure

Global Compliance

The Global Compliance team identifies and prioritizes compliance risks and determines if they are effectively managed. Global Compliance activities not only reduce the likelihood of non-compliance with ADP policies and applicable laws, but also contribute to ADP’s profitability and growth by supporting compliance as a centerpiece of our products and services.

Global Compliance also offers our associates advice, training, counsel and support on all aspects of ADP’s Anti-Bribery policy.

Ethics and Compliance Training

Every year, each associate completes our Code of Business Conduct & Ethics training, with 100% participation and completion achieved again in FY’23. We also conduct specialized compliance trainings specific to our associates’ roles. This training is supplemented by awareness programs and initiatives such as internal articles, blogs, videos and other global compliance communications.

Integrated assurance and risk management

All assurance functions, including both Global Compliance and Global Ethics, take an integrated, systemic approach to risk management. They are based on a coordinated model of coverage between business line management, which has responsibility for the day-to-day control environment, and the assurance functions. Our Board of Directors, acting directly and through its committees, is responsible for the oversight of ADP’s risk management activities. With Board oversight, ADP has implemented programs and practices that are designed to inspire ethical behavior, manage and govern risk to protect the Company’s brand and reputation and grow shareholder value.

As part of our Integrated Assurance process, the ADP Chief Data Office (CDO) oversees overall data governance, particularly as it relates to our analytics offerings. In addition, the CDO works closely with our Global Security Organization, our Privacy Team, and our business units on improving data security and access and use of data across the Company. The CDO also houses our Core AI Team, which governs deployment of AI models and through machine learning operations, monitors their performance.

Artificial intelligence (AI) at ADP

ADP holds the trust of its clients and their employees at the heart of our mission, vision and values. As technology evolves, new opportunities arise; with them, however, can come the potential for unintended effects. These innovative new tools must also be used in a way that is ethical, secure, and compliant.

ADP has adopted a rigorous set of principles and related processes to govern its use of AI, machine learning, and other newer technologies. We established a Data and Ethics Council of internal and outside experts to evaluate and advise on ethical questions related to novel technologies and use of data, including artificial intelligence. We continuously work to safeguard our trusted data set by building in rigorous standards to deliver unbiased, independent, and objective insight into the workforce.

We also believe that human oversight is essential to the reliable operation of artificial intelligence and machine learning (ML) models and making proper use of their results. We strive to develop ML models that are explainable and direct, with clear purposes. Our solutions provide recommendations to human decision-makers, which they can then decide how to act upon. We monitor the performance of our AI offerings (as noted above) and take an inclusive approach to developing AI.

As the largest single source of U.S. tax payments and employment tax reports, ADP has considerable expertise in tax administration and other employment-related administrative matters.

Our approach to AI and ML also emphasizes the isolation of unintended bias. We are vigilant not to reproduce bias in any AI-enabled product or service. Even when accounting for potential unintentional bias in source data, coding, or use of an AI-enabled product or service, there can be unexpected or unforeseen bias that come into play. ADP’s goal is to continually strive to identify new and unexpected sources of bias and then refresh and enhance the design of our client offerings to address them.

We are implementing the U.S. National Institute for Standards and Technology’s AI Risk Management Framework, which adopts a govern, map, measure, and monitor framework for identifying and addressing AI-related risks.

To learn more, please see our website.

Facilitating our clients’ compliance

ADP designs products and solutions to help our clients meet their particular compliance obligations. This includes delivering updates and best practices on the latest legislative and regulatory developments through the ADP SPARK blog. To see examples of how ADP designs compliance into our products and services, visit our ADP SmartCompliance® page.

Public policy and government relations

As the largest single source of U.S. tax payments and employment tax reports, ADP has considerable expertise in tax administration and other employment-related administrative matters. We contribute to sound government policy as well as laws and regulations by educating and engaging with policymakers, agencies and regulators. For example, ADP met with IRS senior officials to discuss improved electronic services for employment tax administration and worked closely with the Treasury Department and IRS to seek guidance and alignment on the 2022 SECURE 2.0 retirement plan legislation. ADP also met with state officials from California and Illinois to offer technical advice for their new pay equity reporting requirements.

Campaign contributions

ADP has a strict policy of “no financial support” for any political candidate, party or government office worldwide. ADP does not contribute funds to political campaigns of any sort and does not sponsor or maintain a political action committee (PAC). Read more in our Political Contributions Policy and in our Code of Conduct.

Eye on Washington team

ADP maintains a staff of dedicated professionals who carefully monitor federal and state legislative and regulatory measures affecting employment-related human resource, payroll, tax and benefits administration, and help ensure that ADP systems are updated as relevant laws evolve. To learn more, please visit our website.